Imagine you’re a kid who depends entirely on your parents, and they leave you with $500 to survive for a month. Would you spend it all in a single week and go hungry for the next three? Or would you budget wisely so it lasts the entire month?

Prop trading works in a similar way. Proprietary trading firms provide you the capital to trade with. Every of these accounts has a fixed percentage of losses permitted, and your account gets breached (terminated) if you exceed those drawdown limits.

As a forex trader who is after consistent profitability, you don’t want to breach your account in one attempt. Why? Because the outcome of a single trade is not guaranteed, while the outcome of a series of well managed trades can result in consistent profits over time. That is exactly why understanding and applying proper risk management strategy is of great importance for every forex trader.

What You’ll Learn:

- What does risk management really mean in prop trading?

- Why is risk management important for long-term success in prop trading?

- 7 proven risk management strategies for your prop accounts

- How to create a personal risk management plan for your prop account

Now, let’s kick off outright!

What Does Risk Management Really Mean in Prop Trading?

‘Prop trading is when you trade with a firm’s capital – these firms allow you to control larger capital for a small fee.’

Every business comes with risks; forex and prop trading are no exceptions. You’ve probably heard the saying, “Risk management is what allows you to trade tomorrow.” This is because the market is highly unpredictable. However, proper risk management helps you survive your losing days – you could even call it the savior!

If you’re reading this, we’ll take a wild guess that your next question is: “What exactly is risk management?

Risk management is how you identify, control, and limit potential losses in your trading account to ensure long-term survival and consistent profitability. It is the foundation that keeps you in the game. It is what decides whether you get that payout you want or if you restart the challenge.

In prop trading, risk management is highly essential. It is what keeps your account safe from major losses. Every prop firm gives a set of rules such as the drawdown limits – daily drawdown and overall drawdown – to limit potential losses. These rules make it even more important to have a clear, personalized risk management strategy in place to protect your capital and maintain long-term consistency.

Why Is Risk Management Important for Long-Term Success in Prop Trading?

Have you ever blown your account in your first few attempts, only for your setups to start playing out perfectly after you no longer have an account? You’re left with nothing, just staring at the screen – maybe even crying, reminding yourself how much you could have made if you hadn’t blown your account.

You don’t want to get caught up in scenes like that, and that is precisely why you need to manage your risk properly – so that one or few losses do not result in permanent loss of your accounts.

Here are five main reasons why risk management is important for long-term success:

-

1. Protects your account against drawdown:

Even the best traders lose sometime and A+ set ups hit SLs. You never can tell which trade would end up in win, same way you can’t tell which would lose. Do you still remember prop firms have drawdown rules, as we mentioned earlier? Proper risk management ensures you do not easily breach these rules if you’re facing losing streaks.

-

2. Keep your emotions in check :

It is easy to get carried away by your emotions during losing streaks especially when you risk too much. When you already know how much you can afford to lose per trade or per day and you do not go above it, you are less likely to panic or make emotional decisions. This helps you maintain discipline and confidence in your trading plan.

-

3. Minimizes losses and maximizes profits :

You don’t want to be the forex trader who hits his drawdown limits when a single loss comes. You want to minimize your potential loss and at the same time maximize your potential wins. This is why position sizing, stop-loss and take-profit orders come in. Ideal position sizing (risk per trade) ranges from 0.5% to 2% depending on your approach – although most forex traders prefer the 1% rule. While for a proper stop-loss and take-profit order, it is important for your potential profit to be more than your potential loss. This way, your losses become minimal while your profits become maximal.

-

4. Ensures consistency :

Controlling your risk through position sizing, take-profit and stop-loss orders, and discipline allows you to stay longer in forex trading business. Since you cannot totally avoid losses, you preserve both your capital and mental wellbeing by controlling them. Thus, losing little on bad days and profiting on good days make long term profitability achievable.

-

5. Compliance with prop firm rules:

Prop firms operate on strict already established trading rules. When you trade with a prop firm, you agree to abide by their conditions – such as maximum daily loss, overall drawdown limits, and consistency rules, among all others. Violating any of these can lead to serious consequences, ranging from loss of your funded account or denied payouts to complete termination of your trading privileges. To stay profitable and secure your funding, it’s essential to trade within the firm’s rules at all times.

7 Proven Risk Management Strategies for Your Prop Account

We’ve already discussed what risk management is in prop trading and why it plays a crucial role in achieving long-term success in forex trading. According to Investorpedia, risk management is an essential – yet overlooked – prerequisite to successful active trading. This further reinforces the fact that mastering risk management strategies is important if you want to become consistently profitable in forex trading.

Next, we’ll walk you through seven proven risk management strategies to help you protect your capital, increase your chances of passing prop firm challenges, and consistently get funded payouts from your trading accounts.

-

1. Develop a Trading Plan

There’s a common saying: “He who fails to plan, plans to fail.” This applies to trading as well. Planning is one of the key factors that determines whether you pass or fail, breach or make a payout from your prop account.

The number one way to manage your prop account as a forex trader is to have a predefined plan. This plan should outline your goals, strategies, entry and exit rules, position sizing, daily risk limits, and all other guidelines that dictate how you manage your account.

Why should you keep a trading plan? It serves as a guide that keeps you disciplined, consistent, and protected from emotional trading decisions.

-

2. Stop-loss and Take-profit Orders:

Stop-loss and take-profit orders are among the most effective tools for managing risk on your prop firm account. Your exits are just as important as your entries. .Because knowing when to enter a trade isn’t enough; you must also know when to get out, whether in profit or loss. That is why it is crucial to master how to place your stop-loss and take-profit levels. After spotting an entry opportunity, your next question should always be:

“Where should I place my stop-loss and take-profit orders?”

In a downtrend, your stop-loss should sit above the invalidation level, while in an uptrend, it should be placed below the invalidation level. Your take-profit, on the other hand, should target the next price level or liquidity zone where price is likely to react.

A well-placed stop-loss protects your capital, while a precise take-profit locks in your reward. Together, they form the backbone of consistent risk management.

| Invalidation Levels: | Invalidation levels are specific areas that you do not expect price to reach – when price gets to these levels, it confirms your bias is wrong. Hence you exit the position. |

|---|---|

| Profit Targets: | A price target is a predetermined level where you expect price to reach in the future. This can be recent highs or lows, liquidity pools, next imbalance levels or next supply and demand zones. |

-

3. Position sizing (the 1% rule):

If you’ve been trading for a while, you’ve likely heard the advice “Never risk more than 1% of your account.” While there’s no universal percentage, the key is to find a balance that protects your prop account without slowing your progress.

At GhostPip, we recommend risking between 0.5% to 2% per trade, depending on your trading style, win rate, and trade frequency. For examples:

- If you are a day trader with around a 40% win rate and you take up to 10 trades per week, you might stick to 1% or lesser risk per trade to absorb drawdowns comfortably.

- As a Swing trader with an 80% win rate and roughly five trades per month, you can consider up to 2% risk since fewer, higher-quality setups provide more confidence.

-

4. Keep a Detailed Trading Journal:

The difference between a trader that keeps journals and one that doesn’t is like the difference between a student who writes notes in class and one that doesn’t. When it is time for exams, one has notes to read while the other doesn’t. You can tell which of them will have the highest score

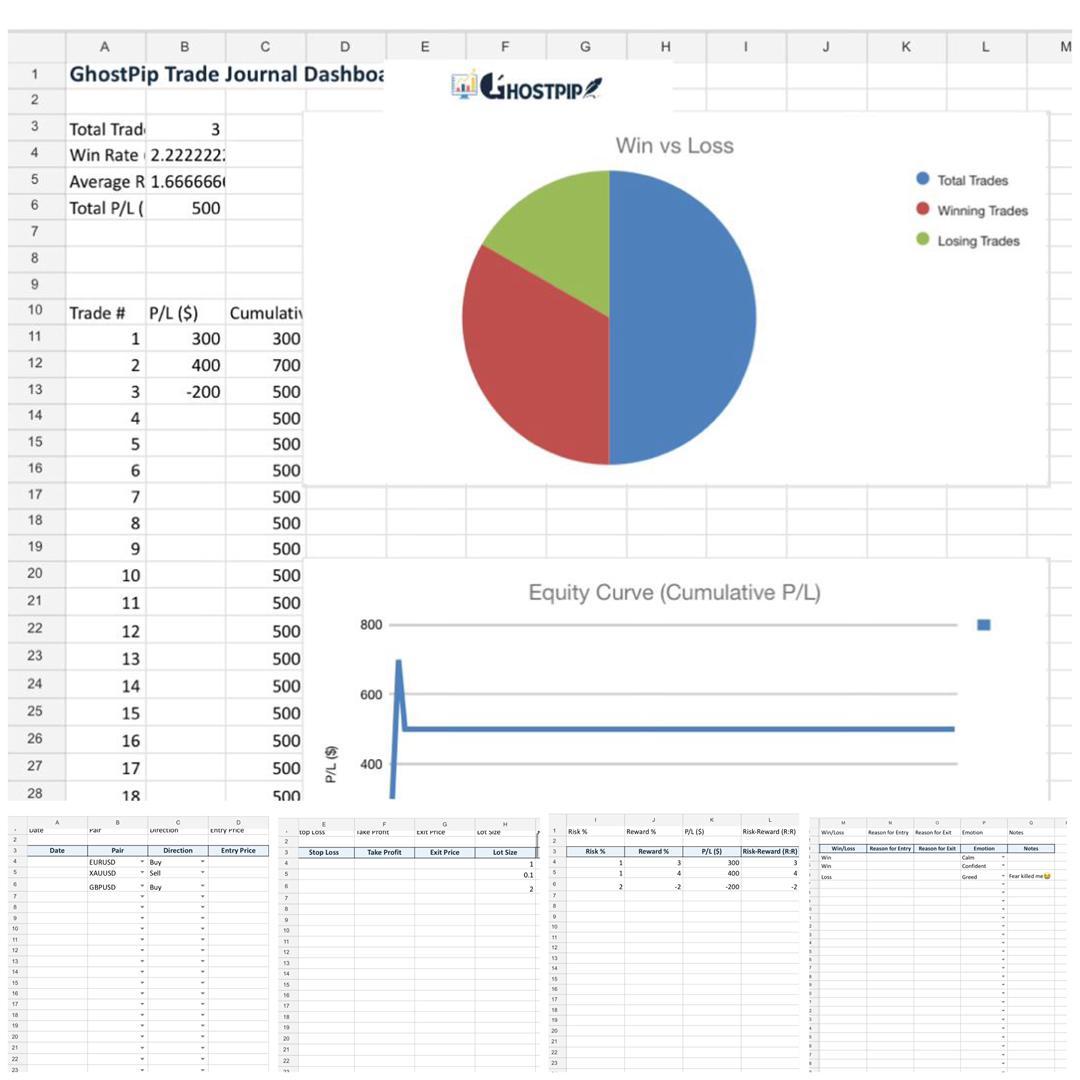

Your trading journal is your friend. It tells you how you’re performing and how you can improve your performance. It should include : date, pair, direction, entry price, stop-loss, take-profit, exit price, lot size, risk percentage, reward, p&l, risk-reward, win/loss, reason for entry, reason for exit, emotion, and what you note about the trade.

We have a trading journal designed for you which includes all the details listed above. In addition, you also get to track your progress on your dashboard.

Sign up to our newsletter here and have yours delivered right into your inbox.

Sign up to our newsletter here and have yours delivered right into your inbox.

-

5. Plan Around The Daily and Max Loss Limit of The Prop Firm You Trade:

A recent stat from Funderpro (published on August 25, 2025) revealed that “breaching a daily drawdown is the most common way traders fail a prop firm challenge.”

This tells us one thing – if you can avoid violating your daily drawdown rule, you’re already ahead of most traders in keeping your account alive. Always ensure your personal daily loss limit is lower than the maximum allowed by your prop firm. For example, if your firm allows a maximum daily loss of 4%, consider setting your own limit around 2–3%.

However, knowing your daily drawdown isn’t enough – it is equally important to understand your maximum overall loss limit. This limit represents the total amount you can lose on your prop account before it’s automatically terminated. Once this threshold is breached, the account is closed, regardless of how well you’ve traded before.

Always keep track of your equity relative to this limit, and build a safety cushion to stay comfortably within the firm’s rules. Proper awareness of both daily and overall drawdown limits is what separates consistent prop traders from those who lose funded accounts too early.

| Daily loss limit | the maximum amount a prop firm allows you to lose in a day |

|---|---|

| Overall loss limit | the maximum amount a prop firm allows you to lose during the course of trading the account |

-

6. Focus on High Probability Set-ups Only:

What are high probability set ups? They are trade ideas which tick all (or the most important) criteria on your checklist. These set ups have clear entry and exit levels ( take-profit and stop-loss), show up at the right time and on the right pair. In other words, everything about the trade fits right into your trading plan

Every trader takes losses. Even the best setups can hit stop-loss due to market volatility or unexpected news. But by focusing on high-probability setups, you’re playing a numbers game in your favor—taking only trades that offer the highest likelihood of success over time.

Most traders fail challenges because they take low quality trades out of boredom, greed, or fear of missing out. Thus, this separates the profitable traders from the unprofitable ones.

-

7. Understand The Rules of The Firm You’re Trading With:

Risk management in prop trading covers much more than the amount or percentage you risk on your trades. Unlike your personal trading accounts, they have already established rules which you are to follow. Violating these rules either result in soft breach or hard breach of your account.

If you want to manage your account effectively, you have to understand and follow all the rules guiding the account, as a single violation might cost you your account – you don’t want to be a victim of such circumstances!

‘Where can I find these rules?’ The rules guiding a prop firm account are usually found in the FAQ section of their website. The most common ones are the daily and maximum drawdown, lot size limit, news trading rule, minimum holding time, and consistency rule among all.

How to Create a Personal Risk Management Plan for Your Prop Account

If you’ve been following us from the beginning, your next question is probably, “How can I create my own personal risk management plan for my prop account?” Good question. To help you build a plan that fits your trading style and prop firm rules, follow these simple steps below:

-

1. Understand your prop firm’s risk rules :

Every firm has its established risk rules – the daily loss limit, overall loss limit, leverage, and lot limits. Before setting your personal rules, know exactly what the firm allows. Your personal rule should always be stricter. If for your instance your firm’s daily loss limit is 4%, make yours 3% to 3.5%.

-

2. Define your risk per trade :

Decide how much of your account you are willing to risk on a single trade. Your decision should not just be about feeling, but based on available trading data and your trading strategy. If for instance you take up to four trades per day, you should consider risking less than 1% per trade.

-

3. Set minimum and maximum risk to reward ratios :

Risk/reward ratio (RRR) is a key component of any effective risk management strategy. It measures how much you are willing to risk on a trade compared to the potential reward. At Ghostpip, we advise that every trade you take must have the potential of giving you a reward more than you are risking. This keeps you profitable even with a lower win rate. Setting maximum RR also guides you against on-trade emotions such as greed and fear.

-

4. Simulate what-if scenarios :

Some traders blow their prop accounts because they fail to consider “what if” scenarios. For example, if your strategy historically wins 5 out of 10 trades, it’s easy to assume that losses will always be spread out. In reality, there’s no fixed pattern – losses can occur consecutively or at random. Before deciding your risk per trade, ask yourself: “What if all the losses happen one after the other?”

-

5. Stop-Loss and Take-Profit Orders:

Every trade you take should have logical stop-loss and take-profit levels. Your stop-loss must be based on invalidation points, not random guesses. Likewise, your take-profit should be set at a realistic target, not just a number that looks like it gives more profit. A common beginner mistake is assuming, “I’ll set my take-profit here because it looks big,” without considering if the market is likely to reach it.

-

6. Set emotional and psychological limits :

If you have been trading for a while, you would agree with us that trading is not just about strategy and numbers. Your mindset plays a huge role in your success. A report by Finance Magnates (April 20th, 2025) cited a survey of 2,777 prop traders conducted by PipFirm, which found that 38% of traders struggle with discipline, self-control, or revenge trading. These psychological pitfalls lead to unnecessary losses and even account breaches. Setting clear emotional and psychological limits like knowing when to stop trading after a loss or avoiding impulsive decisions will help protect both your capital and your mind.

-

7. Create a Trading Check-list:

Once you’ve determined all the criteria discussed in this section, create a trading checklist to guide your decisions. Before entering a trade, ask yourself: “Have I met all my pre-trade criteria?” While the trade is active, check whether your in-trade criteria are being followed. And after exiting the position, review whether you adhered to your post-trade criteria. Using a checklist ensures discipline, reduces emotional mistakes, and keeps your trading consistent.

Conclusion:

Risk management is the backbone of every profitable trader’s success. While it’s impossible to eliminate risk entirely, learning to manage it effectively gives you a clear edge in the markets. This involves developing a solid trading plan, setting logical stop-loss and take-profit levels, maintaining a detailed trading journal, planning around your drawdown limits, understanding your prop firm’s trading rules, and focusing only on high-probability setups. If you want to stay in the business for a long run, you realize consistent risk management in prop trading doesn’t just protect your capital, it ensures you stay in the game long enough to grow it.

Join 1,000+ traders who receive daily market insights, trading tips, psychology hacks, and free trading resources straight to their inbox. Stay ahead of the markets and sharpen your trading edge – subscribe to our newsletter [here].

This is really helpful!

Thank you

We’re glad you found this helpful!

Very educative, thanks for this.

Stay tuned for more educational posts!

Pingback: HOW TO START FOREX TRADING IN NIGERIA (2025 GUIDE)

Pingback: The Dark Psychology Behind Why Most Forex Traders Lose Money

Pingback: How To Pass Your FTMO Evaluation Account (Step-by-Step Guide)

Great and very insightful!

Pingback: Top 7 Reasons You Should Trade with Prop Firms in 2026 (and How to Navigate the Challenges) - GhostPip

thanks for this knowledge bro

very educational

Thanks for your feedback!

Very helpful, thanks for sharing

Pingback: Prop Firm Evaluations Guide: How to Pass in 2026 - GhostPip