Introduction

FTMO came into existence in 2015, 10yrs ago. They have built their reputation over the years as one of the earliest prop firms in the forex prop trading industry. Aside from their longevity, they prove their reliability through payouts, excellent trading conditions, active customer support system, and supportive community.

To crown it all, FTMO is a 5-star rated firm on TrustPilot, a top prop firm review website. As of today, they have 4.8/5 reviews by over 32,000 traders.

With these, it is not a surprise that many new forex traders are running to trade with FTMO. Every forex trader wants a reliable prop firm to trade with, especially in an unregulated space like a prop firm trading.

However, the reality of trading still remains: more forex traders fail than those who actually pass. And the question of “how do I pass my FTMO challenge?” is what this blog post addresses.

There is no holy grail strategy to pass your FTMO evaluation. You need to understand their rules, have a working strategy, build a solid risk management plan, and have the discipline to stick to your trading rules.

In this guide, we shall break down FTMO trading rules, why most traders fail their FTMO evaluations, and how you can pass your FTMO evaluation account.

What You’ll Learn

What is FTMO evaluation and why do most traders fail it?

Step-by-step blueprint to pass your FTMO challenge

Most common mistakes that make traders fail FTMO and how to avoid them

Best trading plan for passing your FTMO account

11 trading psychology hacks you need to pass your FTMO evaluation

Recommended tools to boost FTMO challenge success

What is the FTMO Evaluation & Why Do Most Traders Fail It?

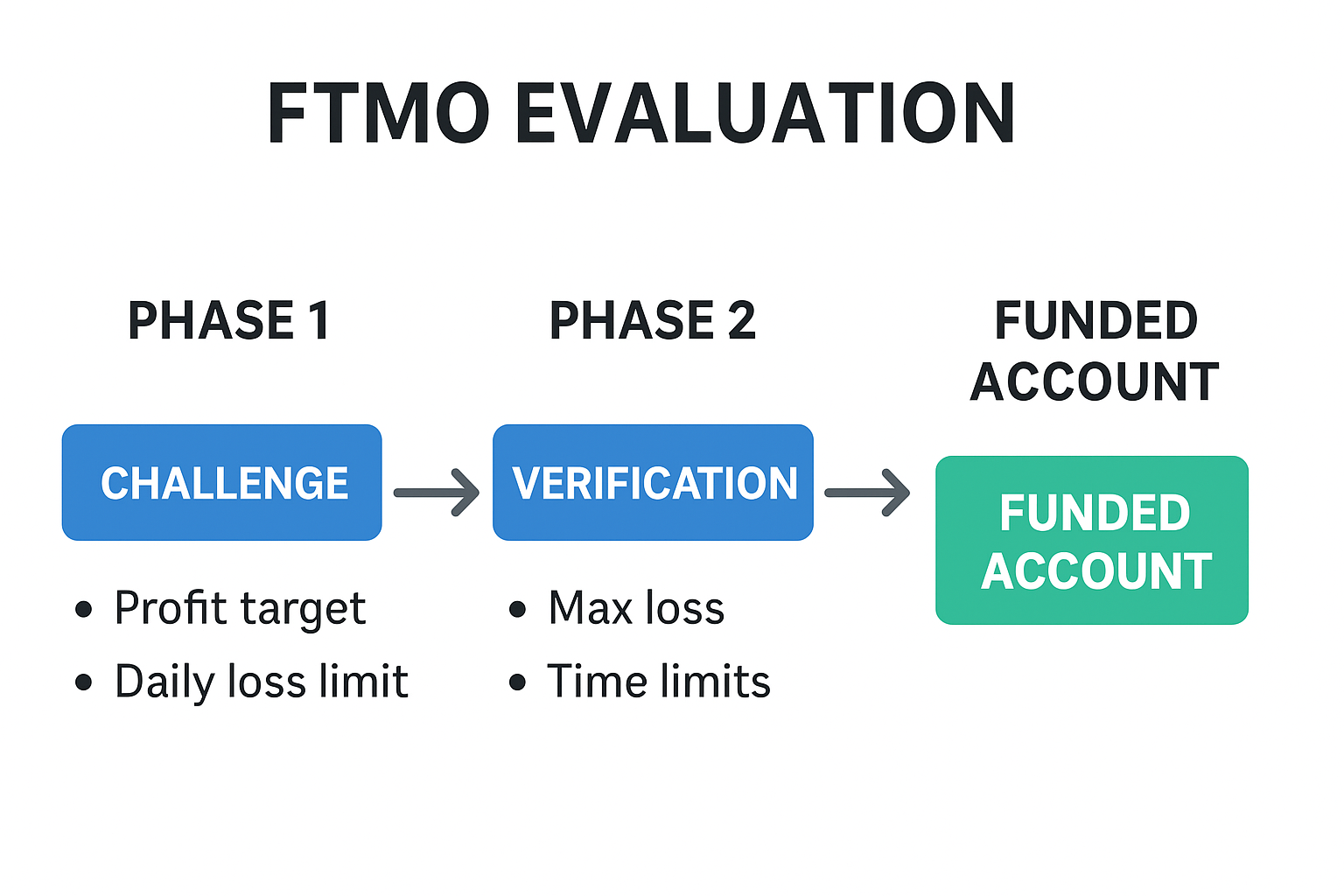

The FTMO evaluation is a program you must pass in order for you to get funded on FMO. It is a two step evaluation which you purchase for a fee. Step 1 is called the FTMO challenge and the second step is the Verification phase. Once you pass these two steps, you proceed to the funded phase known as the FTMO trader. You can withdraw the profit you make at this phase and get paid up to 90% of it.

Why do most traders fail the FTMO challenge?

Open your X or any other social media account, type “prop account breach.” You see a lot of traders’ posts about how they breach their prop firm accounts. It’s not a surprise that most statistics point at only 5% to 10% success rate.

A statistics released by TradersUnion early this year pointed at an 80% to 95% failure rate — I.e 80% to 95% of traders who purchase prop firm accounts breach it at evaluation phase.

According to some sources, up to 95% of traders breach their prop firm accounts at evaluation phases while less than 2% keep their funded accounts for a notable period of time.

This tells you it’s not just about FTMO traders, it’s about traders generally. However, the prop firm you trade with also has hands in how successful you become. Factors like how friendly their rule is and how great their trading conditions are, also contribute to success rate.

Trading with FTMO is not hard. Most traders fail their evaluations because they do not understand FTMO rules, while some others fail because of indiscipline. Only a few truly lose because of market uncertainties.

Let’s take a quick look into why most traders fail their FTMO evaluations:

- Overtrading: over trading is when you take more trades than your strategy presents. Some traders are already addicted to clicking the buy/sell button. They trade out of boredom, frustration or desire to satisfy their wants.

- The rush to hit the profit targets: most traders trade in a hurry to hit their profit target so they can advance to the next phase. They want to meet the 10% profit required to pass phase one quickly so they can advance to phase two. They want to meet the 5% profit requirement for phase two in the hurry to advance to the funded stage. They can’t wait to make money, even though they end up not making it at the end.

- Lack of a working strategy: if you give a demo account to some traders, they won’t make any profit on it. Why? They do not have a real edge. But you see them rush to purchase an FTMO account because they want to make big money.

- Daily loss limit violation: FTMO daily loss limit is a percentage of your account which you are not allowed to lose in a single trading day. This limit is set at 5% of your FTMO account. If for instance you purchase a $10,000 FTMO account, your daily loss limit is set at $500. Crossing this limit automatically results in account breach.

- Psychological barriers: your brain is wired to make you lose money in trading. These cognitive biases lead traders to chase trades, revenge-trade, or even grow overconfident. We discuss these dark psychology and how to take control over it in our blog post.

Step-by-Step Blueprint to Pass Your FTMO Evaluation

Step 1: Understand The Rules (Most Traders skip this)

One of the key differences between your personal trading account and a prop account is that a prop account has established rules. Violating these rules results in a soft or hard breach of your trading account.

FTMO is one of the firms with the most traders-friendly rules. This makes it easier for you to navigate through. Let’s take a look at the top rules you should pay attention to, if you want to pass your evaluation with ease.

- Daily loss limit: you have a daily loss limit of 5%.

- Maximum overall loss: you have a 10% overall loss limit.

- Profit target: you are to meet a profit target of 10% in phase one and 5% in phase 2.

The first thing for you to do is to allocate your risk per trade and per day in a way that will not breach your daily loss limit. And also in a way you’ll not easily breach your max loss limit.

Let’s go through a practical guide on a $10,000 FTMO account:

The table below contains the balance, daily loss limit, max loss limit and profit targets (phase one / phase two) for a $10,000 FTMO account

| Starting Balance | Daily Loss Limit | Max Loss Limit | Profit Targets |

|---|---|---|---|

| $10,000 | $500 | $1,000 | $1,000 / $500 |

If the number of trades you take in a day ranges between two to three, you want to allocate in a way that you’ll violate your $500 daily loss limit

You can choose between 0.5% to 1.5%. With this, you’re sure you’re not violating your daily loss limit even if all three trades for the day hits SL.

Check out other forbidden trading practices and risk management rules here in FTMO FAQs.

Step 2: Stick to One Trading Approach on Your FTMO Account

Switching between multiple trading strategies on a single account is one of the fastest ways for you to fail your FTMO evaluation.

Do not immediately switch to another strategy when you take a loss on the current one. Here is why:

- It confuses your edge

- Your risk management becomes inconsistent

- It reduces consistency

- It leads to psychological stress

- It becomes harder for you to evaluate your performance

Make sure you have a trading approach you already mastered before taking an evaluation account.

Step 3: Trade High Quality Set ups Only

One sure shot to increase your chances of passing your FTMO evaluation is to focus on high quality set ups only.

What is a high quality set up? The definition of a high quality set up varies depending on your strategy. Generally, a high quality set up is a trade that meets all your confirmations.

Although the outcome of a trade is not guaranteed, taking these types of trades increases your odds of winning.

Step 4: Develop FTMO Risk Management Rules

One FTMO evaluation passing tip you must not overlook is risk management. It is the backbone of every funded trader you see out there. Ask any FTMO trader you see out there, they’ll tell you risk management is non-negotiable.

Why should you develop a risk management plan?

- To avoid violating FTMO risk rules

- To protect your FTMO account from large losses

- It ensures you stay consistent

- It reduces emotional trading

- It helps you scale up faster

What should your risk management plan contain?

- Account size and risk per trade

- FTMO daily loss limit awareness

- FTMO maximum drawdown awareness

- Your trading frequency and position sizing

- Risk/reward ratio

- All FTMO trading rules and forbidden trading practices

- Your contingency rules (stop trading after… e.g taking three losses in a day)

- Journaling and review (subscribe to our newsletter for an advanced journaling template specifically designed for you. You get to journal your trade details, your emotions, and you also get automatic equity curve, win rate, p&l, and account growth)

We have a full risk management guide for your prop account here on our website.

Step 5: Develop a Trading Plan and Follow it

A trading plan is a must-have for any trader who wants to pass FTMO evaluation with ease. Your trading plan is what tells you what to do, when to do it, and how to do it.

What should your trading plan contain?

- Your trading goals

- Your trading strategy

- Your risk management rules

- Trade management plans

- Market selection – the pairs you trade

- Trading session rules

- Your journal and review process

- FTMO challenge psychology rules

- News trading rules

- Contingency rules

All these keep you prepared in advance.

Why should you keep a trading plan?

- It helps you stay consistent

- You avoid violating daily loss limit

- It reduces emotional trading

- It helps improve your performance

- You pass your FTMO evaluation faster

Trading Plan That Passes FTMO Evaluation with Ease

Trading pairs: if you take about 3 to 5 trades on a single pair per week, consider trading not more than 2 to three pairs. e.g EURUSD, GBPUSD and XAUUSD

Sessions: London/New York or if Asian works for you

Risk per trade: 0.5% to 1.5%

Maximum number of trades per day: 2 to 3

Strategy: your tested and trusted trading strategy

Stop loss: place your SL at invalidation zones

Take profit: minimum of 1:2RR or 1:3RR

Goal: pass phase 1 and phase 2

The table below is a sample plan for a $10,000 FTMO evaluation account

| Balance | Pairs | Sessions | Risk Per Trade | Max Trade/ Day | Strategy | Stop Loss | Take Profit | Goal |

|---|---|---|---|---|---|---|---|---|

| $10,000 | EUR/USDGBP/USDXAU/USD | London/New York | 1% =$100 | 2 | liquidity sweep + order blocks | place at invalidation zones | place at next area of liquidity | pass phase 1 and phase 2 |

Disclaimer: this plan is for educational purposes only, not financial advice. Trade responsibly!

Most Common Mistakes That Cost Traders Their FTMO Accounts and How to Avoid Them

One of the fastest ways to succeed where others are failing is to identify their mistakes and learn how to avoid them. If you want to stay ahead of 70% of FTMO traders, here are the common mistakes you should avoid at all cost:

- Ignoring trading rules

- Neglecting the daily loss limit

- Overtrading

- Fixing unrealistic time to pass evaluation

- Trading news recklessly

- Increasing lot size after a big win or a loss

- Trading emotions

- Gambling

If you can avoid these common mistakes, you’ll be in a better position to pass your FTMO evaluation with ease.

Below are quick fixes to these common mistakes:

- Re-read all FTMO rules before placing your first trade

- Pay attention to your daily loss limit and max drawdown

- Keep a trading plan and follow it

- Consider staying out of news events or take partial profits before news

- Track your emotions and keep them in check

- Practice discipline on and off the chart

FTMO Challenge Example (Realistic Math)

Let’s walk you through how a real strategy performs in the FTMO market

Strategy: Liquidity sweep + order block

Pairs: EURUSD and XAUUSD

Risk per trade: 1%

Win rate: 50%

Trade per week: 5 to 6

Average RR = 1:3

If you take a total of 10 trades in two weeks and you:

win 5

Lose 5

Loss = 5 x -1(%) x 1(R) = -5%

Win = 5 x 1(%) x 3(R) = +15%

15% – 5% = 10%

Phase one passed 🎉💯

Week 3:

You take 5 trades

You win 3 and lose 2

Loss = 2 x -1(%) x 1(R) = -2%

Win = 3 x 1(1%) x 1(R) = 9%

Outcome = 9% – 2% = 7%

Phase two passed 🎉💯

It is important to note that you have to meet these FTMO objectives in order to become an FTMO funded trader.

Note that : real life trading is much more challenging compared to paper trading. Trading your FTMO account will test your strategy and your discipline. However, if you follow the guide we have provided and you build your approach around it, you’re definitely due for a win in the end.

11 Trading Psychology Hacks You Need to Pass Your FTMO Evaluation

Every loss and account breach email you see you out there are not sponsored by bad strategies or negligence of trading rules. The truth is, a good number of traders suffer from the dark side of trading psychology. Until they break free, it may be hard for them to experience a break through.

Here are eleven trading psychology hacks you need to pass your FTMO evaluation:

1. Stick to Your Plan

- Don’t chase the market or deviate from your strategy.

- Trust your rules, even after a losing streak.

2. Manage Emotions

- Avoid revenge trading after losses.

- Use deep breathing or short breaks to stay calm.

3. Focus on Process, Not Profits

- Track risk management, trade setups, and execution, rather than obsessing over gains.

- Consistency beats big wins.

4. Keep Risk Small

- Limit risk per trade (usually 1–2% of account).

- Protect your daily loss limit to avoid blowing the account.

5. Journal Every Trade

- Record reasons for entry, exit, and emotions felt.

- Helps spot repeating mistakes and refine your strategy.

6. Accept Losses

- Losses are part of trading.

- Treat them as feedback, not failure.

7. Avoid Overtrading

- Only trade when setups match your plan.

- Less is often more in evaluation accounts.

8. Maintain Discipline

- Follow rules even under pressure.

- FTMO evaluates consistency more than aggressive gains.

9. Visualize Success

- Mentally rehearse sticking to rules and handling losses calmly.

- Builds confidence and reduces emotional reactions.

10. Take Breaks When Needed

- Step away after a string of losses or emotional trades.

- Returning with a clear mind improves decision-making.

11. Control Your Environment

- Minimize distractions while trading.

- Keep your workspace organized and free from stress triggers.

- A focused environment helps you stick to your plan and make clear decisions.

If you want to gain more insights about the dark psychology behind why most traders lose money – and how to break free from it, read our full trading psychology blog post.

Best Free Trading Tools To Increase Your Chances of Passing Your FTMO Evaluation

Here are top free trading tools to aid your trading and increase your chances of passing your FTMO evaluation:

- TradingView: for charting and analysis. You can upgrade to premium to access some features

- Forex Factory: to stay updated about upcoming high impact news events. The high impact news are labeled with red color.

- Lot size calculator: to determine the lot size that fits your risk.

- Risk-reward calculator: to determine how much your potential loss and profits are

- Pip calculator: to determine how many pips you’re risking and how many pips you’re gaining.

Conclusion

Passing your FTMO evaluation is a product of good strategy, solid risk management, trading plan, and keeping your psychology in check.

We have already discussed what FTMO evaluation is and why most traders fail it. We also discussed the step-by-step blueprint to pass your FTMO evaluation, together with practical approaches.

If you follow this blueprint strictly, you dramatically increase your chances of getting funded.

If you’re looking to get started with FTMO, grab an account with our affiliate link and DM us the word FTMO on X to get added to our FTMO traders community.

Want to get started with FTMO? Sign up or get an FTMO account with our link.

Want more educational trading contents and prop firm passing tips?

Join 1,000+ traders who receive daily market insights, trading tips, psychology hacks, and free trading resources straight to their inbox. Stay ahead of the markets and sharpen your trading edge – subscribe to our newsletter [here].

📌 FTMO Evaluation — FAQ Section (2025 Updated)

1. What is an FTMO Evaluation?

The FTMO Evaluation is a two-phase test (Challenge + Verification) designed to assess whether a trader can follow rules, manage risk, and trade profitably before receiving a funded account.

2. How long does the FTMO Evaluation take?

You get 30 days for the Challenge and 60 days for the Verification. You only need to trade a minimum of 4 active days in each phase.

3. What are the rules for passing the FTMO Challenge?

To pass, you must follow three conditions:

- Don’t exceed the Daily Loss Limit

- Don’t exceed the Maximum Loss Limit

- Do not violate any trading rule and do not partake in any forbidden trading acts

4. What is the Daily Loss Limit?

It is the maximum amount you can lose in a single day. If this amount is crossed, you automatically breach your trading account.

5. What is the Maximum Loss Limit?

This is the total drawdown allowed from the initial starting balance. If your equity goes beyond this limit at any time, your evaluation becomes invalid.

6. What profit target do I need to pass?

The profit target depends on the account size, but typically:

- 10% profit target in the Challenge

- 5% profit target in the Verification

7. Can I use any strategy in the FTMO Evaluation?

Yes. Scalping, swing trading, day trading, EAs, and algorithmic trading are allowed, as long as:

- You follow risk rules

- You avoid restricted behaviors (e.g., latency arbitrage)

8. Can I trade during high-impact news?

Yes, news trading is allowed, but it increases volatility. Many traders fail evaluations due to news spikes hitting daily loss limits.

9. Why do most traders fail FTMO evaluations?

Common reasons include:

- Overleveraging

- Breaking the Daily Loss rule

- Emotional trading

- Switching strategies

- Trading too many pairs

- Poor risk management

10. What is the profit split after passing?

Funded traders typically receive up to 90% of all profit payouts.

11. How does the scaling plan work?

If you maintain consistency and profitability over four months, your capital can increase by increments – allowing for higher profit potential.

12. What is the best strategy to pass the Evaluation?

There is no universal “best” strategy, but successful traders typically:

- Trade 1–3 major pairs

- Stick to one trading model

- Trade only during high-liquidity sessions

13. Is risk management important for passing?

Yes, it’s the number one factor. You can fail even with a profitable strategy if your risk is too high or inconsistent.

14. Can beginners pass the FTMO Evaluation?

Yes, although beginners often struggle with discipline and rule management. Proper training, a clear plan, and rigid risk control are essential.

15. What happens after I pass the Verification?

You receive your funded account credentials. From that point, you trade with real capital under the same rules, but now you are eligible for monthly payouts.

16. Can I retake the FTMO Challenge if I fail?

Yes, you can always try again. Some traders fail more than once before mastering risk and consistency.

17. What is the best time to trade during an Evaluation?

Most FTMO traders prefer:

- London session

- New York session opening hours

These periods offer clean volatility and better trade execution.

18. Can I trade multiple accounts at once?

You can trade multiple evaluations, but you must avoid copy-trading or mirroring accounts in a way that violates rules.

19. Does weekend holding affect my evaluation?

Weekend holding is allowed, but market gaps can cause unexpected drawdowns. Many traders avoid it for safety.

20. What tools should I use to help pass the Evaluation?

Recommended tools include:

- Position size calculator

- Trading journal

- Economic calendar

- Charting platform

- Volatility indicators

Check out the official FTMO FAQ section for all the trading rules and objectives.

Pingback: Top 7 Reasons You Should Trade with Prop Firms in 2026

Very educative, thanks 🙏

Putting in more work from now

Detailed information, thanks for sharing.

Pingback: FTMO 1-Step Evaluation: Rules and Features Compared to 2-step