Introduction

Every forex trader begins the journey with one dream: achieving financial freedom. For many, trading appears to be the fastest escape from financial struggle. For others, it seems like the perfect opportunity to multiply wealth. But regardless of background, almost every beginner enters the market with the same belief:

“If I can just catch one big move, my entire life will change.”

This dream is fed heavily by social media. Flashy wins, profit screenshots, and overnight success stories create the illusion that forex is a quick, effortless path to riches. So you step into the market with unrealistic expectations and a dangerous mindset.

But reality hits quickly. You soon discover that trading is nothing like the polished highlight reels you see online. It is not a casino game based on luck. In forex, you earn every result through skill, discipline, and emotional control.

You develop a trading strategy and assume the hard work is done, only for you to realize you’ve barely scratched the surface. You begin to battle overconfidence, unrealistic expectations, and the pressure of wanting fast results.

What happens next?

Then the losses come. After the market humbles you, fear of losing, fear of failure, and self-doubt take over. You start questioning your ability, you question your strategy, and your decisions.

Then you begin a deep process of character reformation. With time, your discipline grows and your mindset changes — still, the truth is:

You can never completely eliminate psychological traps in trading. You only learn how to manage them.

Even professional traders still face emotional trading mistakes. The only difference is they have built the mental framework to handle it.

In this guide, we break down the dark psychology behind why most forex traders lose money, and more importantly, how you can escape the psychological traps preventing you from becoming consistently profitable.

What You’ll Learn

- The hidden psychological traps that make most traders lose

- How social media creates unrealistic expectations

- Why your brain is wired to make you lose (cognitive biases)

- The dark side of risk and reward psychology

- How to break free and finally trade profitably

Table of Contents

- 1. Introduction

- 2. What You’ll Learn

- 3. The Hidden Psychological Traps That Make Most Traders Lose

- The Illusion of Control

- The “I Am Smarter Than the Market” Syndrome

- The Addiction to Dopamine

- The Fantasy of One Big Trade

- 4. How Social Media Creates Unrealistic Expectations

- 5. Why Your Brain Is Wired to Make You Lose (Cognitive Biases)

- Loss Aversion

- Confirmation Bias

- Gambler’s Fallacy

- Overconfidence Bias

- Recency Bias

- 6. Why These Psychological Findings Matter

- 7. How to Break Free and Finally Trade Profitably

- 8. Conclusion

- 9. FAQ

The Hidden Psychological Traps That Make Most Traders Lose

Trading psychology refers to the thoughts, emotions, and mental habits that influence how you make trading decisions in the market.

If you’ve been trading for a while, you’ll agree with one truth:

You don’t blow accounts just because you lack a trading strategy, sometimes you blow accounts because your mind works against you. Without realizing it, you fall into psychological traps that quietly ruin your performance.

These traps affect every trader differently. Factors like how badly you want success, your background, your environment, your access to information, and whether you have a mentor all influence how deep these traps go.

Below are the silent psychological pitfalls that destroy traders long before they notice what’s happening.

1. The Illusion of Control

At the early stage of your trading journey, you get excited about a new strategy your mentor swears will make you your first $10,000 in a month or three. Suddenly, you feel like everything is under control.

This illusion creates false confidence. It leads to:

- Overtrading

- Revenge trading

- Ignoring stop-loss orders

- Holding losing trades for too long

Why? Because you believe the market will reward you simply because you “did the right thing.” You start saying things like:

- “I’ll definitely win if I just follow my strategy.”

- “My win rate is 90%. Last trade was a loss, this next one will surely be a win. Let me go all in.”

But the harsh reality of forex trading is this:

You can do everything right and still lose money.

This is why emotional control and strong risk management strategies are important to mastering how to trade profitably.

Tip: make sure you always use your stop-loss order, stick to your strategy, and journal your trades.

2. The “I Am Smarter Than the Market” Syndrome

Have you ever felt like you cracked the cheat code of the market?

It usually happens after:

- a streak of wins, or

- a perfect run during backtesting

You start feeling untouchable — convinced you can’t lose. You think you’ve outsmarted the market. But this trading mindset quietly leads to destructive behaviours like:

- risking too much

- skipping risk management rules

- ignoring warning signals because “they’re minor”

This trap blows up accounts silently. When it finally catches you:

- you lose more than expected

- you question if trading is for you

- you convince yourself your strategy is broken

- you abandon it and jump to a new one

- and then repeat the same painful cycle

It’s not the strategy that failed, it’s the psychology behind your decisions.

Tip: accept the reality of trading that no outcome is certain in the market, and always pay attention to warning signals in the market.

3. The Addiction to Dopamine

If you’ve ever placed real money in the market, you already know trading is loaded with dopamine triggers:

- watching charts move

- entering trades

- seeing floating profits

- taking risks

These micro-highs make your brain crave the feeling more than the result. That’s when trouble begins.

You start entering trades simply because you can’t stand being on the sidelines. You don’t want to see candles move without your wallet being attached to the outcome. Before you know it, you’re addicted, without even noticing.

Some traders can’t even let their trades run without checking the screen every 30 seconds. That’s when you hear:

“Let me monitor my running trade.”

You look at them like you’re not sure whether they’re traders or babysitters.

This addiction also leads to fear-driven behaviors:

- exiting trades prematurely

- holding trades too long

- panicking at every fluctuation

Dopamine addiction doesn’t care about strategy. It only cares about keeping you hooked.

Tip: try the set and forget approach – it helps you become my discipline by setting your SL, TP and all the needful at once. You only come back to check at a fixed time e.g before news events, or before the day runs out.

4. The Fantasy of One Big Trade

“One big trade is all you need.”

This single belief has blown more accounts than bad strategies ever will.

Your account is deep in drawdown and you tell yourself:

- “If I can just catch one big move, I’ll recover everything.”

Your system gives you a clean 1:3 setup, but you move your target to 1:7 because you’re desperate to climb out.

You get funded on a prop firm account and immediately say:

- “Let me risk 2% and target 1:5. If it hits, that’s 10% profit in one shot.”

You’ve already spent the imaginary profits before the trade even opens.

But you never stop to ask:

“What if I lose?”

And when you do lose, you chase another big move. You lose again.

You restart at zero.

You change strategy.

You repeat the cycle.

And fail again.

This is not a trading strategy problem, it’s a psychological trap disguised as ambition.

Tip : since the outcome of a single trade is not guaranteed, focus on a series of trade. This keeps your mental health in check.

How Social Media Creates Unrealistic Expectations

Open X, TikTok, Facebook, or any social media platform on any given day. What do you see?

Profit screenshots.

Payout certificates.

Prop firms pass certificates.

TradingView chart predictions.

And endless highlight reels of “perfect trades.”

Even a trader who has only won one out of his last twenty trades will confidently post:

“If you’re a real trader, you should catch this move.”

A mentor promoting his course will say:

“All my mentees caught this. If you were in my VIP room, you wouldn’t miss a setup again.”

And suddenly, you start questioning yourself. You close your device in frustration, wondering if your strategy is wrong or if you’re simply not good enough.

A few hours later, you return to scrolling only to see traders flaunting new cars, designer clothes, and Rolex watches worth more than ten times your entire yearly profit. Social media makes it look like everyone is winning except you.

But here’s the truth:

What you’re seeing is not necessarily reality. It may be marketing curated highlights.

And this illusion creates dangerous psychological effects like:

- Feeling your strategy isn’t good enough

- Thinking you’re not risking enough

- Believing you’re the only one losing

- Over-risking to “catch up”

- Emotional burnout

- Constant pressure to perform

Social media doesn’t show much of the blown accounts, losing streaks, or sleepless nights. It only shows success, making every trader feel behind.

Understanding this illusion is the first step to protecting your mindset and focusing on your own journey, not someone else’s highlight reel.

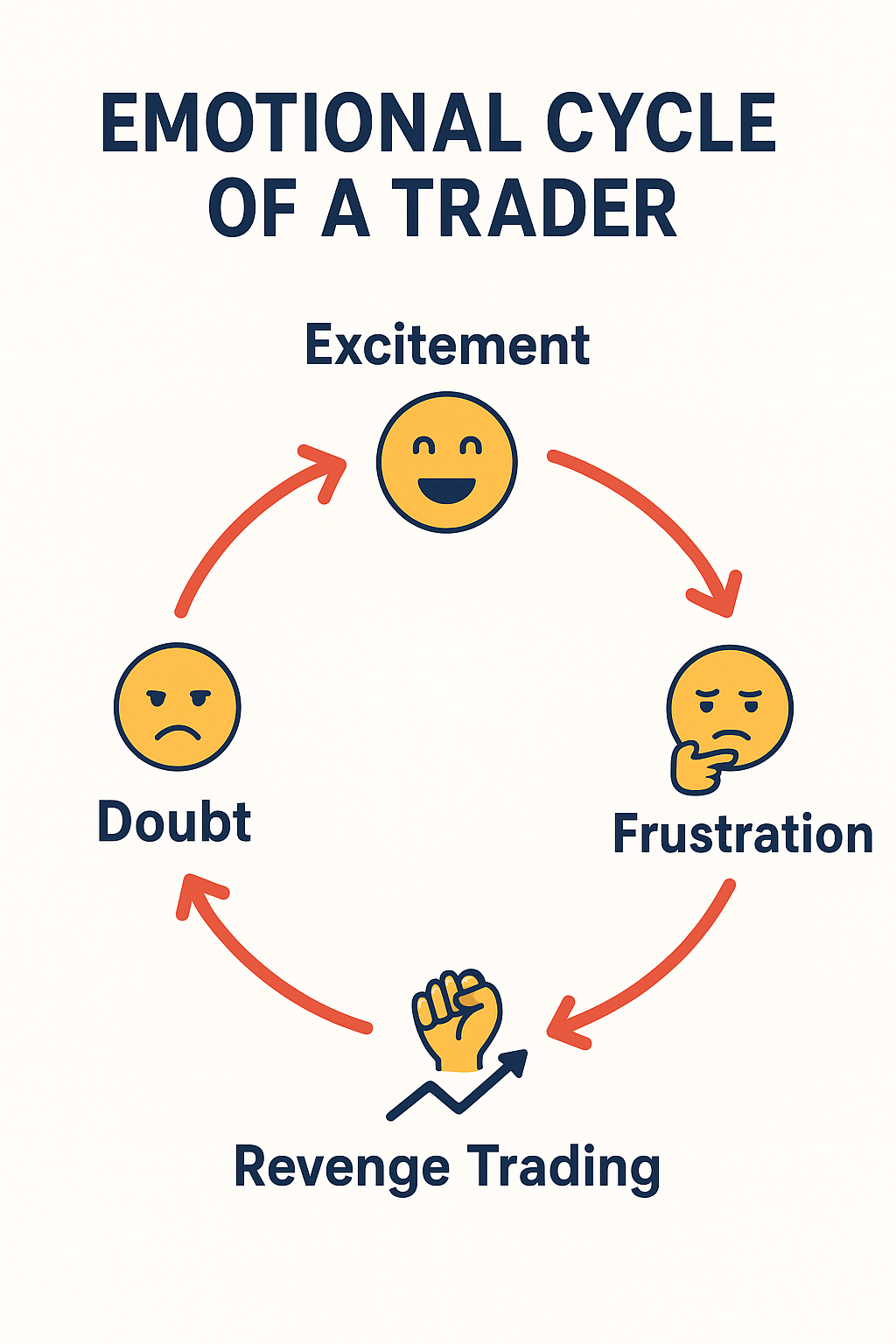

The image below displays the emotional cycle of a trader

Why Your Brain Is Wired to Make You Lose (Cognitive Biases)

Cognitive biases are the mental shortcuts your brain uses to make decisions quickly. The problem? These shortcuts work against YOU in the forex market.

If you don’t know your brain is wired to make you lose, how can you avoid these traps?

If you don’t understand that these biases are a natural part of being human, how can you escape them?

Whether you realize it or not, your brain has built-in patterns that influence every trading decision you make. Your trade runs into profit and immediately you think:

“Quickly close the trade before it starts running into losses.”

Only for you to regret it seconds later.

These shortcuts are called cognitive biases, and they silently ruin your trades even when your strategy is solid.

The image below is a representation of the 5 cognitive biases we would be discussing

Below are the most common psychological traps almost every trader unknowingly battles:

1. Loss Aversion

Compare the pain you feel losing $100 to the pleasure you feel winning $100. Losing hurts far more.

Loss aversion is one of the most important discoveries in behavioral finance, and Daniel Kahneman even won a Nobel Prize in 2002 for this research. This alone proves that loss aversion is not your personal weakness; it is a scientifically proven human flaw.

How it affects YOU as a trader:

- You hold losing trades for too long, hoping for a reversal

- You adjust stop-loss levels because you believe the market will eventually respect your bias

- You close winning trades too early to “secure the bag”

At the end of the day, these loss aversion actions crush your account growth.

2. Confirmation Bias

In 1960, Peter Wason’s cognitive experiments revealed that humans naturally search for information that confirms what they already believe while ignoring evidence that contradicts it.

How it affects you as a trader:

- You force trades to match your bias: you look for entries simply because you woke up with a sell/buy bias, even when the setup isn’t valid

- You ignore warnings like news or invalidation points: you know the outcome of a trade is not guaranteed, but you struggle to accept a loss once you have committed to an idea

- You scroll through social media looking for traders who agree with you: you ignore opposing signals and only seek revalidation

Confirmation bias convinces you that the market must agree with your opinion, and this is where you get trapped.

3. Gambler’s Fallacy

The gambler’s fallacy comes from early behavioral research and was later expanded by Tversky & Kahneman. The findings show that humans misunderstand randomness and probability.

As humans, we instinctively believe that after a series of losses, a win is “due” — even though the odds never change.

How it affects you as a trader:

You might find yourself thinking:

- “I’ve lost my last five trades, the next one must win.”

- “The market owes me after those losses.”

- “A win is coming, let me increase my lot size.”

This belief pushes you into over-risking, revenge trading, and eventually blowing your account.

4. Overconfidence Bias

Financial researchers Brad Barber and Terrance Odean studied thousands of traders across several years.

Their conclusion? Overconfident traders:

- Trade more

- Take bigger risks

- Perform far worse

- Lose more money than conservative traders

The study proves that feeling skillful does not mean you are skilled, especially in a probabilistic environment like forex.

How it affects you as a trader:

- You increase lot size after a winning streak

- You stop following your strategy rules

- You believe you have “figured out the market”

- You blow the account right after your most confident period

Overconfidence makes you your own biggest enemy.

5. Recency Bias

Recency bias comes from memory research by Ebbinghaus (1885) and the Serial Position Effect — which reveals that humans remember recent events more strongly than older ones.

This means recent outcomes influence your decisions more than long-term data.

How it affects you as a trader:

- You change strategy after just one bad week

- You risk more after a few wins

- You lose confidence after a temporary drawdown

- You believe “the market is bad today” based on one losing trade

All these are cognitive biases which force you to make emotional trading decisions, most times without you realizing.

Why This Research Matters For YOU (and Other Traders)

These psychological findings prove something most traders never realize:

Your brain is not designed for trading.

You must fight your natural instincts to become profitable.

If you want to become successful as a trader, you must go through a process of character reformation — rewiring how you think, react, and handle uncertainty.

In the next section, we’ll walk you through how to manage these psychological traps and keep them from destroying your trading journey.

How to Break Free From These Hidden Psychological Traps and Trade Profitably

If you’ve been reading this guide from the beginning, we can take a wild guess at your next question:

“How do I break free from these dark sides of trading psychology and finally trade profitably?”

This section covers the exact practical steps you need to break free from psychological traps and begin your journey toward consistent profitability.

1. Accept That Your Brain Is Wired to Make Mistakes

The first step in solving any problem is acknowledging that the problem exists. Before You can fix Your trading psychology, You must accept one simple truth:

Your brain is not naturally built for trading.

Loss aversion, overconfidence, recency bias, and dopamine-driven impulses are all human traits, not your personal flaws. Recognizing them is the first step to gaining control.

Action Steps:

- Keep a trading journal that tracks trades and your emotions.

- After each trade, ask: “Was this decision logical or emotional?”

2. Develop a Clear Trading Plan and Stick to It

You’ve likely heard the saying: “He who fails to plan, plans to fail.”

A solid trading plan reduces emotional decision-making. When You already have Your:

- risk per trade

- entry and exit criteria

- stop-loss and take-profit

- max trades per day

…You are far less likely to react emotionally in the heat of the moment.

Action Step:

Create a trading plan and treat it like a contract with yourself. Add consequences for breaking your rules if you need extra accountability.

3. Implement Strict Risk Management

The image below represents risk management pyramid

No matter how perfect a setup looks, it can still hit SL.

Since you cannot predict which trade will win or lose, your only protection is risk management. Diversify your portfolio, have a strategic risk to reward ratio, place your stop-loss orders at invalidation points, and define your position sizing rule.

Key Rules:

- Never risk more than Your predetermined percentage per trade

- Avoid chasing losses or increasing lot size after wins

- Always use a stop-loss and respect it

Action Step:

Set Your risk parameters before the market opens each day.

Check our risk management guide here.

4. Practice Emotional Discipline

Your emotions are silent destroyers. Fear, greed, frustration, hope, and overconfidence can melt your account even if you have a solid strategy.

Building emotional discipline is the foundation of profitability.

Ways to Build Discipline:

- Take breaks from the charts when feeling anxious

- Limit social media scrolling to avoid unrealistic expectations

- Use mindfulness or short meditation sessions before trading

Action Step:

Before each session, check:

- Am I calm?

- Am I sticking to my plan?

- Am I trading for the right reasons (not excitement)?

5. Focus on Process Over Profits

Most traders fail because they obsess over making money instead of mastering the process.

Profits follow a process, not the other way around.

Action Step:

Track process-based metrics:

- Did you follow your plan?

- Did you manage risk properly?

- Did you stick to your trading schedule?

Celebrate discipline, not just equity growth.

6. Continuously Learn and Improve

The market evolves daily. The moment you stop learning is the moment you start losing.

Professional traders review, refine, and grow — constantly.

Action Steps:

- Review your journal weekly

- Identify emotional or bias-driven mistakes

- Adjust your plan slowly, not impulsively

Always remember : the market evolves, you shouldn’t stop learning.

7. Surround Yourself With the Right Environment

You become the environment you expose yourself to.

This isn’t just about where you live — your digital environment matters even more.

Social media can poison your psychology or elevate it.

Action Steps:

- Follow educators who focus on process, not flashy results

- Join trading communities that promote discipline and long-term thinking

8. Commit Yourself to Long-Term Growth

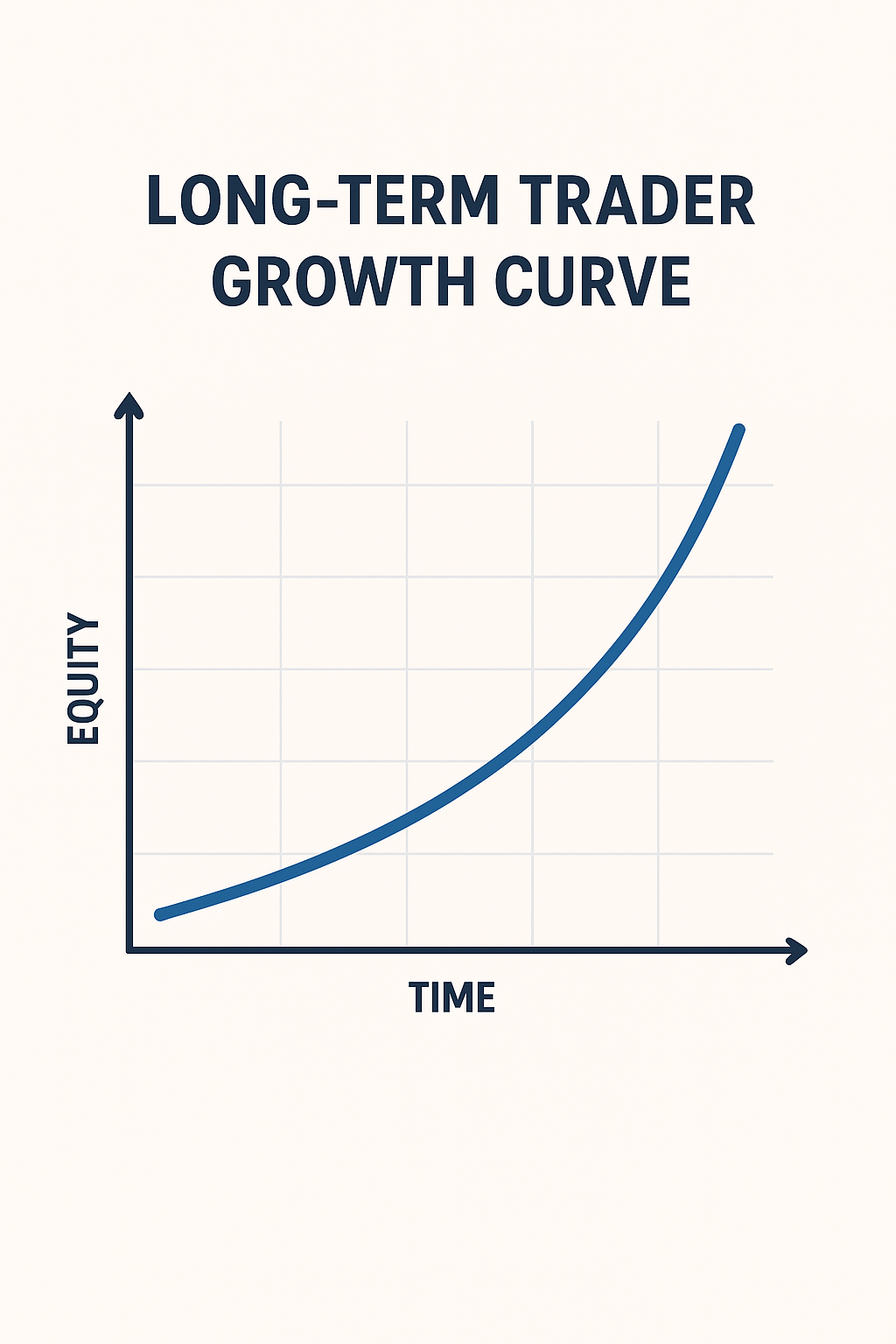

The chart below shows how experienced gained with time increases equity size

Trading is a skill — like fashion design, software development, or medicine. No one becomes an expert overnight.

Consistency, emotional control, and resilience are what separate profitable traders from everyone else.

Remember:

- You can’t eliminate psychological traps, but You can master them

- Discipline and mindset matter more than any single trade

- Every day you stick to your plan, you become a stronger, more skilled trader

Conclusion

Trading is more than a financial journey, it is a psychological transformation.

You struggle with the internal biases, emotional impulses, and subconscious behaviors that quietly ruin your results. Once you understand this, everything changes.

Successful trading isn’t about perfection. It’s about:

- mastering your reactions,

- developing emotional discipline, and

- building a mindset strong enough to withstand uncertainty, volatility, and fear.

You’ll never eliminate psychological traps entirely, but you can keep them under control. Master your mind, and the profits will follow.

Frequently Asked Questions (FAQs)

1. Why do most forex traders lose money?

Most traders lose because of emotional decision-making, cognitive biases, poor risk management, unrealistic expectations, and lack of discipline.

2. What is the biggest psychological mistake in trading?

Loss aversion (the fear of losing) which makes traders hold losses too long and cut winners too early.

3. Does psychology matter more than strategy in forex?

Yes. Many traders have profitable strategies, but few have the discipline to execute them consistently.

4. How can I control my emotions while trading?

By having a clear plan, like defining entry and exit points before trading and using a strict risk management plan, you can control your emotions while trading.

5. Does social media affect trading performance?

Absolutely! Sometimes, it creates pressure, unrealistic expectations, and encourages over-risking.

6. Can a beginner overcome psychological traps?

Yes, a beginner can overcome trading psychological traps through self-awareness, journaling, mentorship, and a disciplined system.

7. Can you become a profitable trader without continuous learning?

No. The market evolves constantly, and strategies weaken if you don’t keep sharpening your skills.

Do you want more trading tips?

Join 1,000+ traders who receive daily market insights, trading tips, psychology hacks, and free trading resources straight to their inbox. Stay ahead of the markets and sharpen your trading edge – subscribe to our newsletter [here].

This is really helpful 👏

Thank you

Thanks for the feedback!

Pingback: How To Pass Your FTMO Evaluation Account (Step-by-Step Guide)

Pingback: Top 7 Reasons You Should Trade with Prop Firms in 2026

Was a good read. Trusting and enjoying the process matters honestly💜

This, right here, is a goldmine. I really appreciate this.

I think Loss aversion is the number one psychology killer for beginner forex traders. The truth is this: Nobody wants to lose or fail. So this alone can cause all the wrong actions listed here, such as revenge trading, over-leveraging, holding trades for long, impatience that results in closing out early, and so many more. The best way to combat this is through Risk management. For each trade, be sure of how much you are comfortable losing, enter the trade, and move on with other things. You train your psychology this way. Thank you so much, ghostpip.

You’re right on point. Thanks for this.