Introduction

What is FTMO? FTMO is a long-standing prop firm that allows traders who pass its evaluation phases to trade with the company’s capital, earning a profit split starting from 80%.

FTMO remains one of the earliest and most reputable prop firms in the forex trading industry. In October 2025, the firm marked its 10-year anniversary, a milestone that reinforces its credibility, stability, and strong reputation among traders worldwide. This longevity is one of the reasons FTMO continues to be one of the most sought-after prop firms today.

FTMO was also among the first firms to bridge the gap between limited personal capital and access to large trading funds. By doing so, it has created opportunities for skilled traders who may not be able to afford large deposits in traditional brokerage accounts but still want to trade significant capital and earn meaningful profits.

In this review, we’ll explore FTMO evaluation model, evaluation rules, funded account rules, trading conditions, reviews, and ultimately answer the question: Is FTMO worth trading with?

What You’ll Learn

In this guide, you’ll learn:

- What FTMO is and how its evaluation model works

- FTMO evaluation rules explained in simple terms

- How much FTMO evaluation accounts cost and whether the fees are refundable

- FTMO profit split, payout process, and how often traders get paid

- What trading styles and strategies are allowed on FTMO

- The pros and cons of trading with FTMO

- Common reasons traders fail the FTMO Challenge — and how to avoid them

This review is based on FTMO’s official rules, platform conditions, and real trader experiences.

What FTMO Is and How Its Evaluation Model Works

What is a prop firm? A prop firm, short for proprietary trading firm, is a company that allows traders to trade the financial markets using the firm’s capital for a relatively small fee, in return for a profit split.

FTMO is a long-standing proprietary trading firm that has been in existence for over a decade. It’s one of the earliest companies to provide large trading capital for traders. Over the years, the company has established itself as a reliable and reputable prop firm in the industry. Hence, this puts FTMO in almost all prop trading conversations.

FTMO Evaluation Model

FTMO, unlike all other firms, has only one evaluation model which is the 2-step evaluation. The evaluation is made up of two phases known as the challenge phase and the verification phase. You advance to the funded phase after you’ve successfully met the profit targets for the two phases of the evaluation.

Let’s have a look at how the evaluation model is:

The FTMO Challenge:

The FTMO challenge is the first of the two evaluation phases. At this initial stage, you’re required to meet a 10% profit target in order to be qualified for the next phase. FTMO does not mandate a time limit within which you are required to pass the phase.

You’re required to abide by all specified trading rules during your trading period. Breaching any of these rules results in termination of your account.

The FTMO Verification:

The FTMO verify is the second stage of the evaluation phase. At this stage, you’re required to meet a 5% profit target in order to be qualified for the FTMO funded account.

Just like the challenge, the trading period for the verification phase is indefinite, and you are to meet this target without breaching any trading rule.

The FTMO Funded Account:

The FTMO funded account is given after you have shown your trading skills in the evaluation phases. It is given to traders who meet all required trading targets for phase 1 and 2 without breaching any trading rules.

At this stage, you’re now trading a funded account and you can withdraw the profits you make. You get a share of profits you withdraw, starting from 80%.

Trading Objectives to Keep in Mind During The Evaluation Phase

- Profit targets = 10% at phase 1, and 5% at phase 2

- Daily drawdown = 5%

- Maximum drawdown = 10%

- Maximum risk per trade = 1%

- Minimum trading days = 4 days

- Trading periods = unlimited

What the Trading Objectives Mean

- Profit targets – specifies the profit (in percentage) which you’re required to make before you advance to the next phase

- Daily drawdown – marks the percentage of your account which your losses in a single trading day are not allowed to cross

- Maximum drawdown – marks the percentage of your account which your overall losses during the trading period is not allowed to cross

- Maximum risk per trade – this is the maximum amount you’re allowed to risk on a single trading.

- Minimum trading days – specifies the minimum number of days you’re required to trade a phase of your account

- Trading period – indicates the maximum number of days you can trade your account

Note: it is important to note that the profits made at the evaluation phase can not be withdrawn. They are solely to evaluate your trading skills to determine if you are qualified to access a funded account.

Trading Objectives Table

The table below presents the trading objectives for your FTMO account, using an $100k account as our examples:

|

Bal. : $100k |

Profit Targets |

Max Risk Per Trade |

Max Daily Drawdown |

Overall Drawdown |

Minimum Trading Days |

Trading Period |

|---|---|---|---|---|---|---|

|

Phase 1 |

$10,000 (10%) |

$1,000 (1%) |

$5,000 (5%) |

$10,000 (10%) |

4 days |

unlimited |

|

Phase 2 |

$5,000 (5%) |

$1,000 (1%) |

$5,000 (5%) |

$10,000 (10%) |

4 days |

unlimited |

|

Funded |

unlimited |

$1,000 (1%) |

$5,000 (5%) |

$10,000 (10%) |

___ |

unlimited |

FTMO Evaluation Rules Explained in Simple Terms

Like every other prop firm, FTMO has a set of rules which you are to follow as their trader. It is important to keep these rules in mind, to avoid losing your account.

Let’s walk you through the trading rules in simple and understandable terms:

-

Daily Loss Limit

The daily loss limit is the maximum amount you’re allowed to lose in a single trading day. If you exceed this limit, your account is breached. FTMO enforces a 5% daily loss limit.

-

Maximum Drawdown Rule

Maximum drawdown rule defines the maximum amount you’re permitted to lose overall. Breaching this rule results in immediate account termination.

FTMO’s overall loss limit is 10%. -

Profit Target

The profit target is the amount you must make to pass a phase or qualify for a payout.

FTMO requires you to make 10% in Phase 1 and 5% in Phase -

News Trading Rule

News trading rules determine whether trading during high-impact news events is allowed. FTMO allows you to trade freely during evaluation phases. However, you’re not allowed to open or close a trade 2mins before and 2mins after a high impact news event, on your funded account. -

Minimum Holding Time

Some firms require trades to be held for a minimum duration before closing, either manually or automatically. -

Minimum Trading Days

This refers to the minimum number of trading days required to complete a phase, regardless of how quickly you hit the profit target. You are required to trade for a minimum of 4 days on the FTMO challenge and verification phases. -

Weekend Holding Rule

You are allowed to hold trades over the weekend during the evaluation phase of your account. However, once you get funded, you’re required to close your trades before the market closes for the week or before a break of more than two hours (e.g Christmas break). If you hold trades for weeks, you should consider the FTMO swing account. -

Inactivity Rules

Inactivity rule defines a period of time which your account is not to be without a trading activity. FTMO requires you open at least one trading position within 30 calendar days.

Check the FAQ section on FTMO official website for more details about their rules.

How Much FTMO Evaluation Accounts Cost and Whether The Fees Are Refundable

The table below presents the official prices for FTMO evaluation accounts as of 7th of January 2026. It is important to note that these prices may reduce anytime the firm has ongoing discount offers.

|

Account Size |

$10,000 |

$25,000 |

$50,000 |

$100,000 |

$200,000 |

|---|---|---|---|---|---|

|

Price (€) |

€89 |

€250 |

€345 |

€540 |

€1,080 |

Does FTMO refund challenge fees? Yes, the fee you pay to purchase your evaluation account will be fully refunded when you request your first payout.

If you’re interested in getting an FTMO account, you can do so using our FTMO affiliate link.

FTMO Profit Split, Payout Process, and How Often Traders Get Paid

Profit split: as an FTMO trader, you hold 80% of the profits you withdraw at first payout. This increases to 90% if you meet the conditions for FTMO scaling plan.

Payout process: you can request payout 14 days after you place your first trade on your FTMO funded account. Processing usually takes 1-2 business days upon confirming the invoice.

FTMO does not have profit requirements for payout. However, you’re required to make a minimum of $20 if you’re withdrawing via bank wire, or $50 if you’re withdrawing via crypto. This is needed to cover the cost of the transaction.

How often do traders get paid? FTMO is known for its reliable and guaranteed payouts. Traders who meet all payout criteria and who have not breached any of the trading rules stated in FTMO FAQs, all get paid.

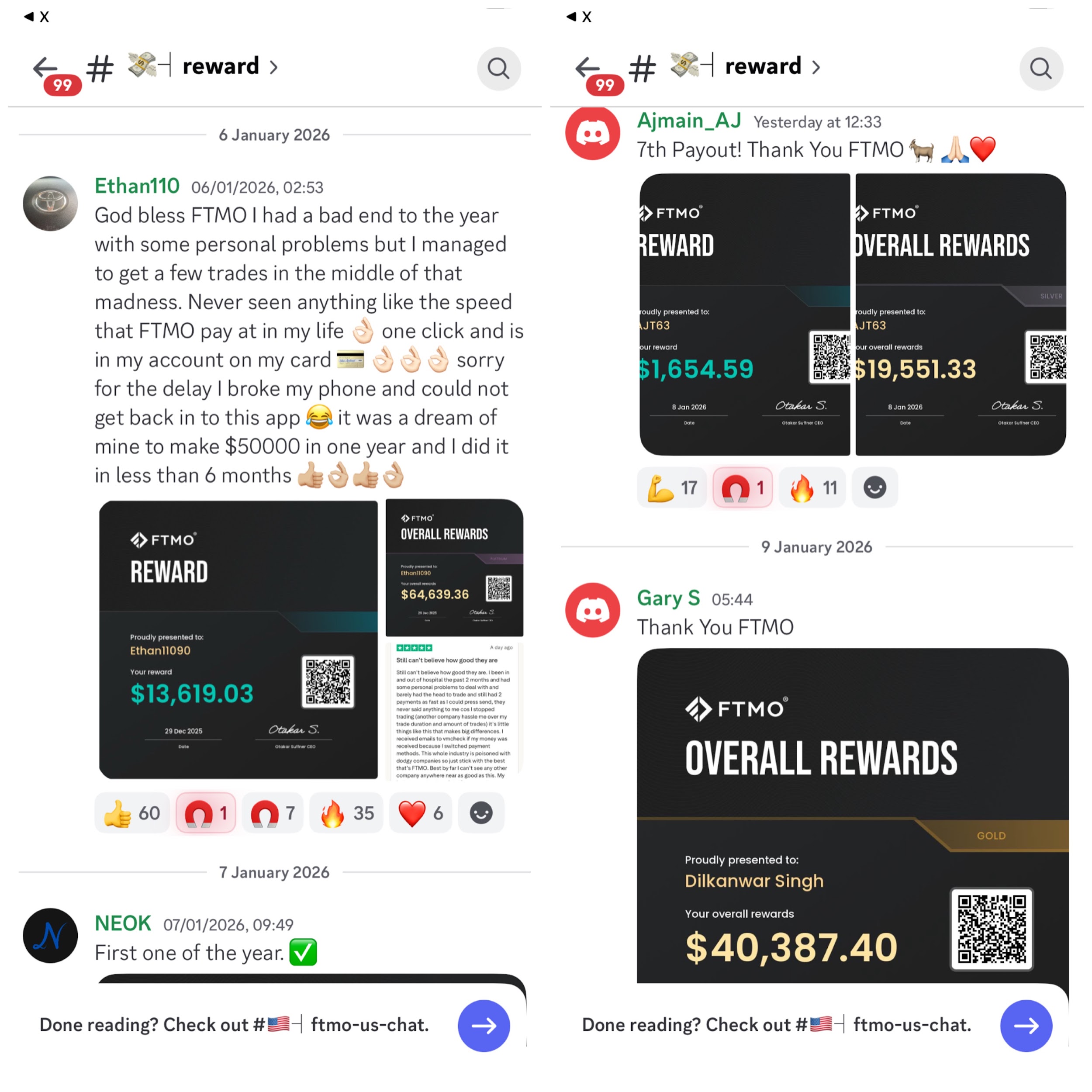

Here are recent rewards posted by traders on the FTMO discord channel👇

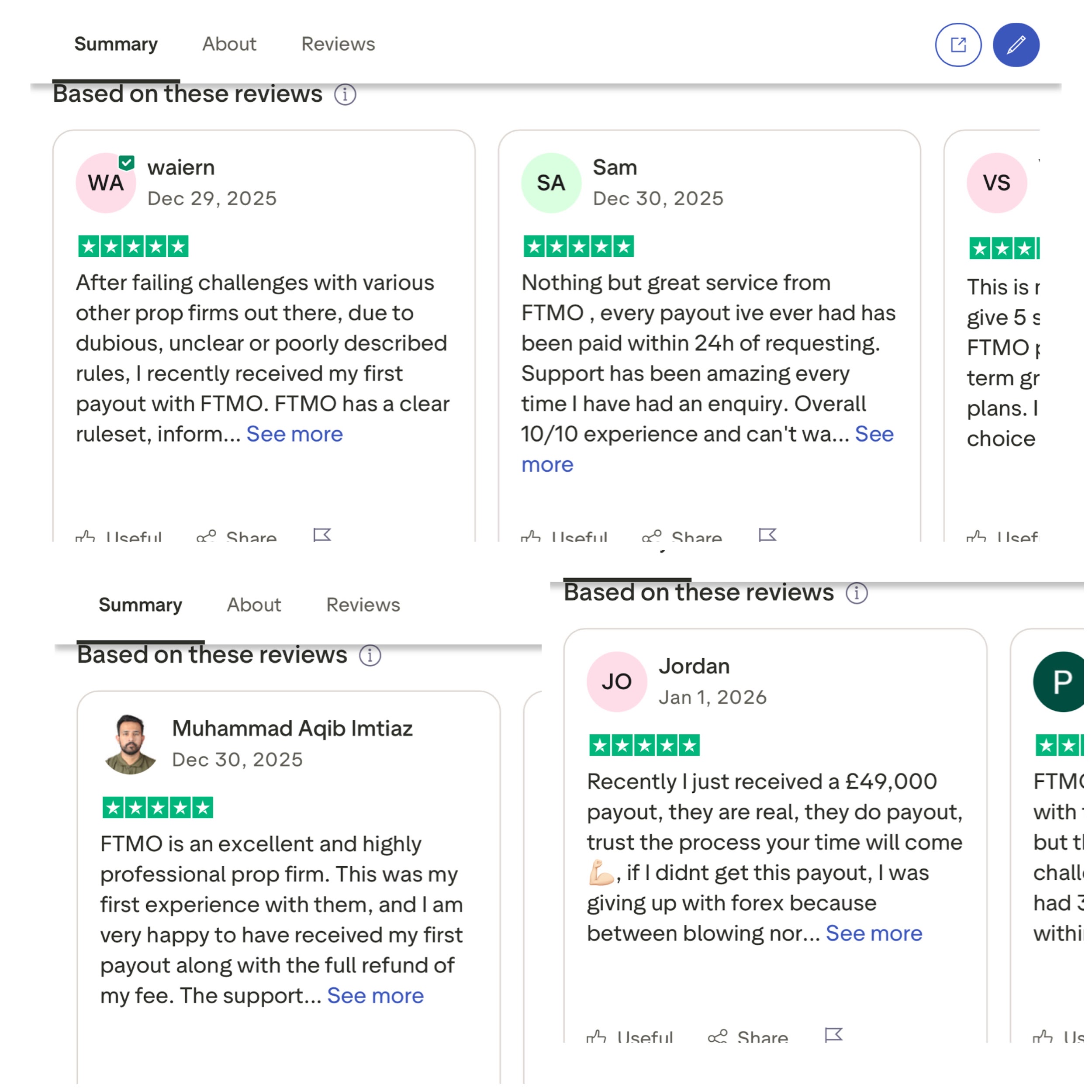

Here are more reviews by FTMO traders on trustpilot👇

What Trading Styles and Strategies Are Allowed on FTMO

FTMO gives you the freedom to trade with your trading strategy so far it is in compliance with FTMO risk rules, and does not match any of the forbidden practices:

- Using trading strategies that exploits errors in FTMO services

- Hedging: simultaneously entering trades in opposite directions, either within your accounts or with a group of friends

- Trading practices that are against FTMO terms and conditions

- Performing gap trading

- Trading 2hrs or less before a market break that is more than 2hrs (e.g weekends, Christmas holidays, etc), unless you’re trading the FTMO swing account.

- Trading with bots or EAs which cause trading accounts to be hyperactive.

- Opening substantially larger or smaller positions compared to your other trades.

- Giving a third party access to your FTMO trading account.

The Pros and Cons of Trading with FTMO

Trading with FTMO gives you some advantageous edge, and it also carries some risks too. In this section, we dive into the advantages and disadvantages of trading an FTMO account.

Pros of Trading with FTMO

1. Access to Significant Capital

You can trade large funded accounts (e.g., up to $400K and beyond) without risking your own money. This is a major advantage if you’re confident in your strategy but lack big capital.

2. High Profit Split

Once funded, traders can keep up to ~90% of profits (often starting at 80% and increasing with consistent performance).

3. Refundable Evaluation Fee

FTMO refunds the challenge fee after your first profit payout, reducing the effective cost of qualifying.

4. Tools, Support & Community

FTMO offers performance coaches, analytics tools, educational materials, and an active global community — helpful especially if you’re still sharpening your discipline.

5. Free Trial

GYou can try FTMO’s system without paying a fee before committing to the full challenge.

6. More Reliable

FTMO is considered one of the most reliable prop firms by many. This merit is earned from their 10yrs+ of consistent service in the industry.

Cons of Trading with FTMO

1. Strict Risk Rules

You must adhere to things like maximum daily loss and total drawdown limits. These can feel restrictive and eliminate many common professional strategies if risk isn’t managed carefully.

2. Fee to Participate

Just like every other firm, you pay to take the challenge, and if you fail you’ll pay again — even though FTMO refunds the fee once you earn profits.

3. Limited Strategy Freedom

FTMO have strict trading rules in place to guide your trading decisions and protect their capital. These rules sometimes restrict your freedom, or at least affect your system. For instance, FTMO does not allow holding of trades over weekends or trading during high impact news, unless your account is a swing account. Also, aggressive risk-taking is not allowed.

All these might be against your regular trading style.

4. Not Financially Regulated

FTMO, just like most prop firms, isn’t regulated by major financial authorities like brokers are. Hence, you rely on internal policies and reputation rather than external oversight. This makes it riskier to trade with prop firms than it is to trade with brokers.

Common Reasons Traders Fail Their FTMO Evaluations

Traders fail FTMO evaluations due to these common trading mistakes:

- Ignoring trading rules: some traders fail to read all rules while some ignore the rules.

- Neglecting the daily loss limit: not paying attention to daily loss limit is one of the fastest ways to lose your trading account. FTMO gives you a 5% limit which you’re to observe.

- Overtrading: over trading is a psychological challenge which most traders, especially beginners, find hard to overcome. They take excessive trades hoping to gamble their way to profitability.

- Fixing unrealistic time to pass evaluation: fixing unrealistic time to pass your evaluation account leads you to blow the account. Instead, focus on executing your edge and accept the time it takes you.

- Trading news recklessly: pay attention to the rules surrounding how you’re allowed to trade during high impact news events. This ensures you do not breach your account recklessly.

- Increasing lot size after a big win or a loss: this is mostly common among beginners. They grow overconfident after big wins. They increase their lot sizes and that might lead to breaching of account if the trade ends in loss. Some also increases their lot sizes after big losses with the hope of recovering if the trade hits tp. However, this only leads to more losses when it doesn’t go well.

- Trading emotions: emotions cannot be separated from humans. However, how you control them determines if you’ll be profitable or not. When your emotions (how you feel) controls your trading decisions, failing your evaluation accounts become unavoidable.

- Gambling: trading without a tested trading strategy is one of the fastest ways to lose your trading account. Before you go into the market, get yourself a reliable trading strategy and trading plan.

We have a full guide published here on how to pass your FTMO evaluations in 2026.

Conclusion

After our full FTMO review in 2026, it’s clear that FTMO remains one of the most reputable and trader-friendly prop firms in the industry. With a transparent fee structure, competitive profit split, flexible challenge options, and well-defined risk rules, FTMO appeals to both aspiring and experienced traders looking to scale their strategies with real capital. The evaluation process is demanding, but that’s part of what makes FTMO’s funded accounts worthwhile — traders who pass the challenge demonstrate discipline and skill, which the firm rewards appropriately.

That said, FTMO isn’t the perfect fit for everyone. The upfront challenge fee and strict drawdown limits may feel restrictive to some, especially beginners still developing consistency. Before committing, consider your trading style, risk tolerance, and readiness to tackle the challenge.

If you’re interested in getting an FTMO account, you can do so using our FTMO affiliate link.